Based on almost three decades of consulting and speaking with hundreds of business owners and lots of bankers, the most common weakness in high-growth companies isn’t a lack of customers, capacity, or courage. It’s a lack of sophisticated financial management.

This results in lousy data, impossible analysis, dire decisions, ineffective allocation of capital, and rotten results. All of this is preventable with proactive, professional financial management.

If you’re a high-growth company executive or owner that wants to improve business results and increase financial performance, or a banker serving high-growth companies, this issue is written for you. This is also an excerpt from my upcoming book, The Four Roads to Business Wealth.

High-growth companies don’t need a CFO to manage debits and credits. Accountants, computer systems and artificial intelligence can do that.

High-growth companies need a Strategic CFO. This financial strategist will guide their growth, attract debt and equity funding, provide real-time business information, and proactively work with the executive team to make better, faster decisions. A Strategic CFO is a sophisticated business advisory and will help you improve business performance and build your business wealth.

When I owned a drywall company a few years ago, we knew our numbers daily, and we could issue an invoice in ten minutes. We also banked where our largest customer banked, so there was no hold on their cheques. With good strategy and good information, you can increase speed!

As a strategic business advisor and consulting CFO, the results I’ve generated for my clients, which were mostly small businesses (annual revenues below $10,000,000 when we started working together), include:

- Hundreds of millions in new revenue (for just one company; lots more when all the clients are added up).

- Finding $5,000,000 of financing to buy a railroad. The company later was acquired for more than $50,000,000.

- 10x revenue growth.

- Turning shareholders (and their sweat equity) into millionaires.

- Introducing bankers that align with management strategies and support growth.

- Initiating relationships and making introductions that lead to business acquisitions and divestitures.

- Helping boards to become real boards and make decisions.

- Helping one board to generate 18 resolutions in a couple of hours and get things done. After the meeting, one board member said, “that was interesting, and it’s never happened before.” The CEO said, “we got more done in three hours than we’ve gotten done in the last three years.”

- Implementing compensation structures that attract and retain top talent.

- Developing strategies that turn business owners who are technicians into wealthy entrepreneurs with a sustainable, differentiated, competitive advantage.

The critical success factors are that the owners and leadership team wanted to grow and were willing to listen to external, expert, experienced advice.

The previous newsletter issue generated several positive responses, so I decided to expand on some points and add a few more.

Here are 14 lessons I’ve learned from starting seven businesses, from working with high-growth companies in Canada and the United States as their Strategic CFO for almost three decades, and from consulting with companies in 62 industries. These lessons are the typical results many of our clients achieve (and why clients and bankers love us!):

- Know your Numbers – many business decisions are made with little credence on hard numbers. Making decisions by gut will give you a gut ache tomorrow, next month, or next year, once the final project costing is completed. We help you know which products, services, customers, and suppliers are helping or hurting your profits and cash flow. Knowing your numbers gives you control.

- Clarify Cashflow – accounting profit isn’t real, it doesn’t pay the bills. Cash pays the bills. Cash is the fuel for operations and growth. We help you get control of your cash—daily and weekly initially—so we know where cash comes from and where it goes.

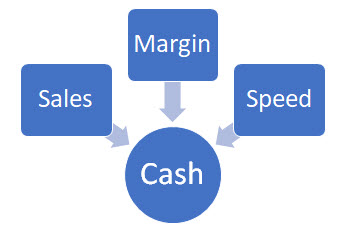

- Accelerate Cash – do you know what your “total days to cash” metric is in your business? It’s probably longer than you think. Cash comes from the formula: sales volume X profit margin X speed of payment. You need all three.

Figure 21.1 The Cashflow Formula

- Buff up the Balance Sheet – many entrepreneurs are solely focused on growing revenues. Yet every banker knows that the balance sheet is the foundation for growth. We help you to strengthen your balance sheet so you can support and attract more and better financing.

Figure 21.2 A Solid Foundation

Photo credit: Phil Symchych

A solid foundation will still support you and perhaps even look beautiful after a few hundred years and a couple of earthquakes.

- Leverage – there is good debt and there is bad debt. We help you optimize your borrowing structure so you properly use leverage as good debt, and avoid bad debt that hurts your balance sheet and hurts your business.

- Stop Minimizing Taxes – too many accountants focus on the false short-term gain of minimizing taxes by paying bonuses. This actually only defers or transfers the taxes. But worse, it weakens your balance sheet by reducing your retained earnings (a.k.a. “equity”) and this significantly reduces your borrowing power. Leverage needs retained earnings to help you grow your business. Paying taxes can generate a 1,032% ROI. Focus on maximizing your business wealth, not minimizing your taxes.

- Improve Accounts Receivable – you are not a banker and you should not be carrying your customers for more than 30 to 60 days. It’s absolutely unethical what large companies, with piles of cash in the bank, do to small and medium privately-held companies when they stretch their payables—which are your receivables—to 90 days or more. You have become your customer’s banker.

- Improve Accounts Payable – your accounts payable is someone else’s accounts receivable. The faster you can pay them, the more credit they will be willing and able to provide to you, and the better prices you can negotiate.

- Rank Customers – all customers are not equal. Just look at your aged accounts receivable to see who is slow in paying you. Your best customers may pay you so quickly they don’t even show up on your month end aging report.

- Internal Processes – the fastest way to improve your results is to generate them more quickly. Yes, that’s obvious and simple, but it’s not common. Can your team complete a product, service or project 10% faster? They likely can if they have clear goals, have resources (time, people, money, authority to make decisions, flexibility, permission to make mistakes and learn), plan ahead for obstacles, and share best practices. The best way to solve problems is to prevent them from occurring in the first place.

- Use Budgets to Grow Faster – budgets don’t constrain you, they help you to go faster because they keep you focused on the best ROI from numerous competing opportunities.

- Partner with a Strategic Banker – The best bankers can proactively help you to structure your business for optimal growth while managing risk. Bankers focus on cash flow, which is real, and which is fuel for your business. Bankers have lots of fuel and they want to give, sorry, sell it to you. Their fuel is cheap, but it comes with (healthy and necessary) covenants and conditions. There’s a reason some huge public companies have been with the same banker for thirty or more years: a healthy, mutually beneficial, trusting relationship.

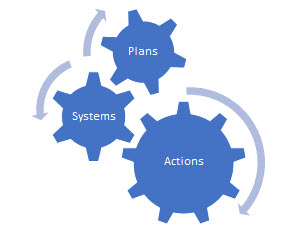

- Structure for the Future – incremental growth is a necessary process for small businesses to figure out how to do what they do. Once they know their technical work, they need to plan for success. Success isn’t growing 10% or 25% over last year’s numbers. Success is developing and implementing business plans and models, management processes, information systems and structures that can support your business at 10x your annual revenues.

Figure 21.3 The Growth Model

- Think and Act Like a Much Larger Company – the key to generate better results is to structure yourself so your systems, processes, and people support success. If your systems aren’t supporting success, they are hindering it. If your people have not been there and done that before, there is lots of learning going on, and you’re paying for learning instead of for results.

If you want to increase the business success that you’ve generated from your marketing and technical brilliance, the best way to addition to your team is a high-level financial strategist. A Strategic CFO can help you build your business wealth.